The Other Suit

Just to lay some quick groundwork, Laurence Girard is owner of New Amsterdam Football Club P.B.C., which operates the New Amsterdam soccer team, and is husband to Lindsey Morgan Sacks, owner of the Chicago House AC soccer team. Both teams are members of the NISA Division III professional soccer league. And both played in the league during the 2021 calendar year. Neither club is included in the plans for the 2022 NISA league season. Girard also owns Fruit Street Health PBC which is the primary sponsor and minority investor in New Amsterdam FC

Per publicly available case and docket information, Laurence Girard and Fruit Street Health PBC filed suit against 10 defendants at the end of December of 2021. The suit was initially filed in the state of New York but, last month, was moved to the U.S. District Court for the Southern District of New York.

The defendants are all companies or individuals affiliated with Yellowstone Capital LLC. Yellowstone provides what are generally known as merchant cash advances to small businesses and their owners who otherwise could not get loans through more typical channels. These MCA companies provide capital in a lump sum payment which then must be paid back over a short period of time via automatic payments, usually daily, which end up totalling a much larger amount when finally repaid. These agreements' usual mechanism for payment is language where the provider purchases a percentage of the debtor’s receivables.

This article matches up the information within the suit with the timeline of Girard’s NISA club, New Amsterdam FC.

The Timeline

According to the documents, Fruit Street and Girard entered into a series of small-business funding agreements with Yellowstone, through Green Capital Funding and Advance Merchant Services starting in November 2019 which ended up with Fruit Street and Girard unable to pay the remaining balance of over $365,000 at the end of 2021.

The initial agreement was with Green CapItal in November of 2019 for $25,000. The three-month repayment terms of $598 per day were based on an estimated 49% of Fruit Street’s daily receivables. The total amount of principal plus interest was $36,375. During this time it was reported that Laurence Girard was the lead investor of a New York-based group that had applied for a team in the National Independent Soccer Association.

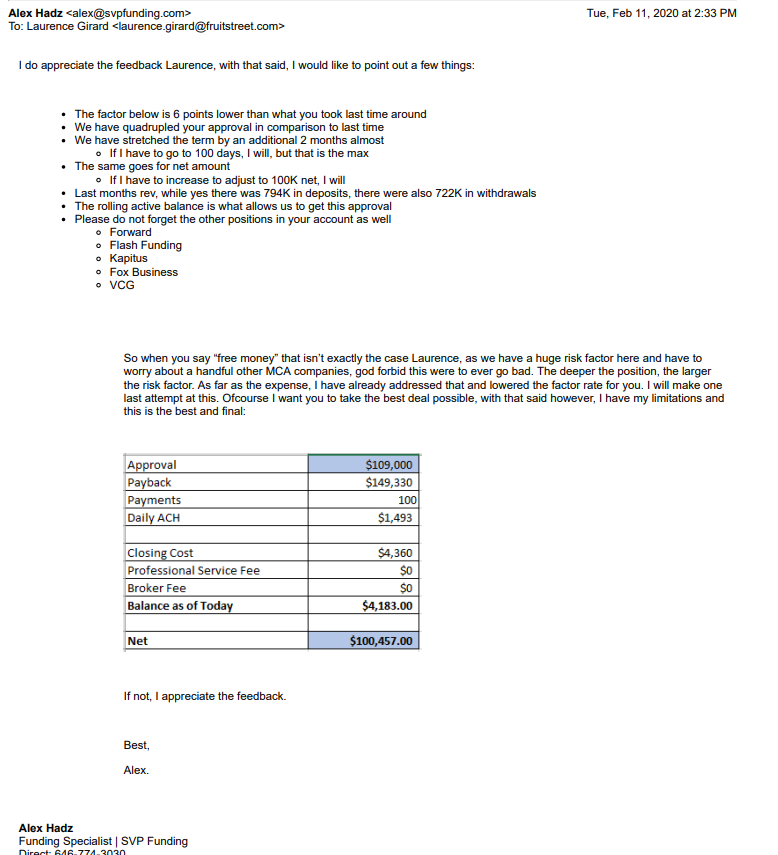

An email submitted as evidence in suit.

Near the end of that period, Fruit Street rolled the remaining balance into a new agreement made with Green Capital in February of 2020. The new amount was $111,000 with a five-month repayment term of $1200 per day again based on an estimated 49% of Fruit Street’s daily receivables. The principal and interest of that agreement totaled $210,980.

An email from February 2020 between Girard and Alex Hadz, a funding specialist with SVP Funding, both named as defendants, is attached to the complaint as an exhibit. The email contains a negotiation of terms for a renewal for the plaintiffs’ first MCA agreement. In it Hadz notes that Girard should “not forget the other positions in your account as well.” Those “positions” are listed as Forward, Flash Funding, Kapitus, Fox Business, and VCG. This would suggest that Girard and Fruit Street were also in repayment to a number of other companies as well as Green Capital. In the same email Hadz states that Fruit Street’s prior months revenue had $794,000 in deposits and $722,000 in withdrawals.

During this time. Girard formed New Amsterdam Football Club P.B.C. as a Delaware public benefit corporation. And, on April 20, 2020, it was officially announced that New Amsterdam FC had become the newest member of NISA.

Near the end of June of 2020, Fruit Street entered into a new agreement with Green Capital. The updated amount was $154,000 with a six-month repayment term of $7999 per week based on an estimated 49% of Fruit Street’s daily receivables. The principal and interest of that agreement totaled $210,980.

In August of 2020, New Amsterdam FC played its first competitive matches in the NISA Independent Cup. Later that month it began its first season of official play in the league which ran through late September.

The parties agreed to another loan in mid-November 2020. The amount was $250,000 with a six-month repayment plan of $12,685 per week based on an estimated 48% of Fruit Street’s daily receivables. The total principal and interest of that agreement amounted to $342,500.

In mid-March of 2021, Fruit Street entered into another agreement with Advance Merchant Services LLC, another defendant named in the case. The agreement was for $150,000 with a four-month repayment term of $3,366 per day again based on an estimated 49% of Fruit Street’s daily receivables. The principal and interest of that agreement totaled $218,550.

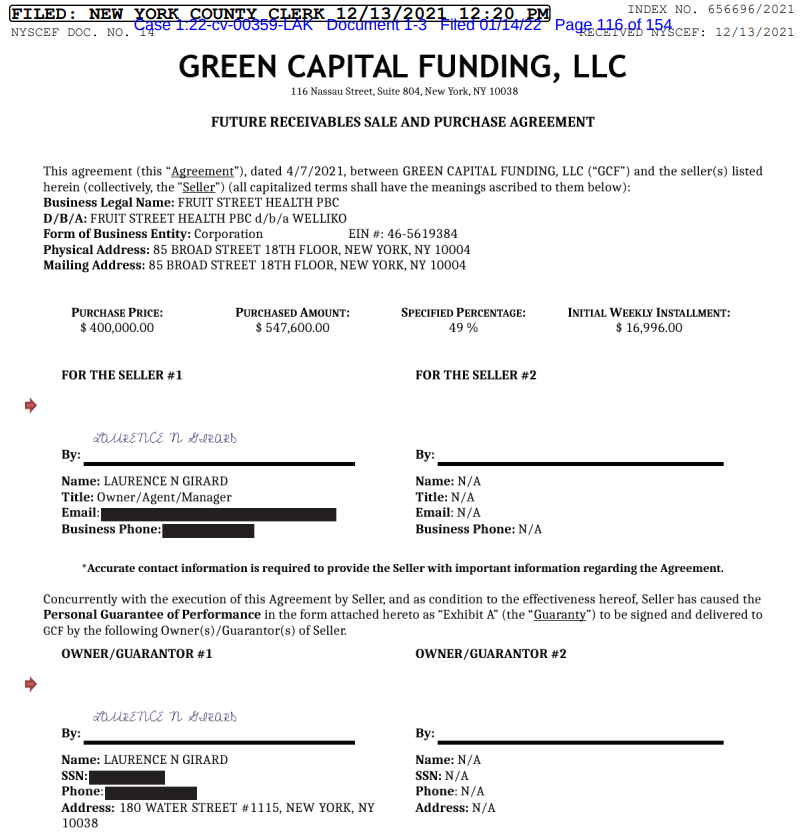

Finally, Fruit Street entered into the sixth named agreement in early April, 2021 this time with Green Capital. That agreement was for $400,000 with a six-month repayment term of $16,966 per week based on an estimated 49% of Fruit Street’s daily receivables. The principal and interest of that agreement totaled $547,600.

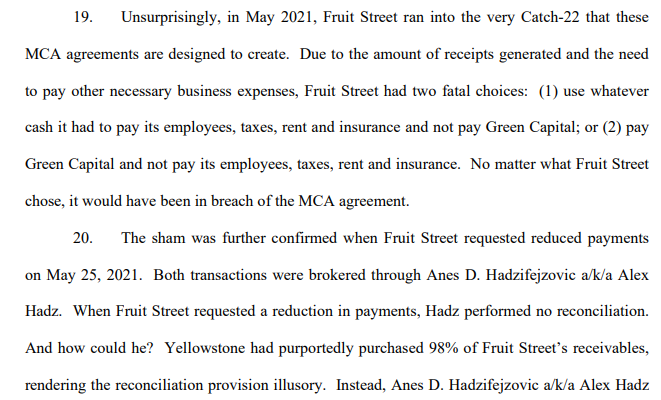

Given the latter two agreements, the complaint notes that, by May 2021, that Fruit Street had sold 98% of its receivables between mid-March and mid-July 2021 to the two MSA companies.

The plaintiffs claim that these agreements are “unlawful predatory lending practices.” They state that what the plaintiffs call MCA agreements or factoring agreements are actually loans. But if the company called them loans they would run afoul of usury laws.

Federal regulators actually went after Yellowstone for improper business practices. Last year, the Federal Trade Commission ordered the company to pay more than $9.8 million to settle FTC fraud charges, much of which could be issued as refunds to the affected businesses. It is not known if Fruit Street or Laurence Girard was one of those affected business.

By May of 2021, the complaint states that Fruit Street did not have enough cash on hand to both pay Green Capital and its other business expenses. As such Fruit Street requested reduced payments to Green Capital on May 25, 2021. While an agreement was reached to reduce the payments on the March 19, 2021 agreement, the complaint states that the April 7, 2021 agreement “had to stay at $10,000 per week” because of “the large balance for that file.”

New Amsterdam FC had returned to play in the Spring 2021 NISA season starting April of 2021. That season ran through mid-June. The team took part in the 2021 NISA Independent cup during July. New Amsterdam would take part in the Fall 2021 NISA season which kicked off in early August and ran through November.

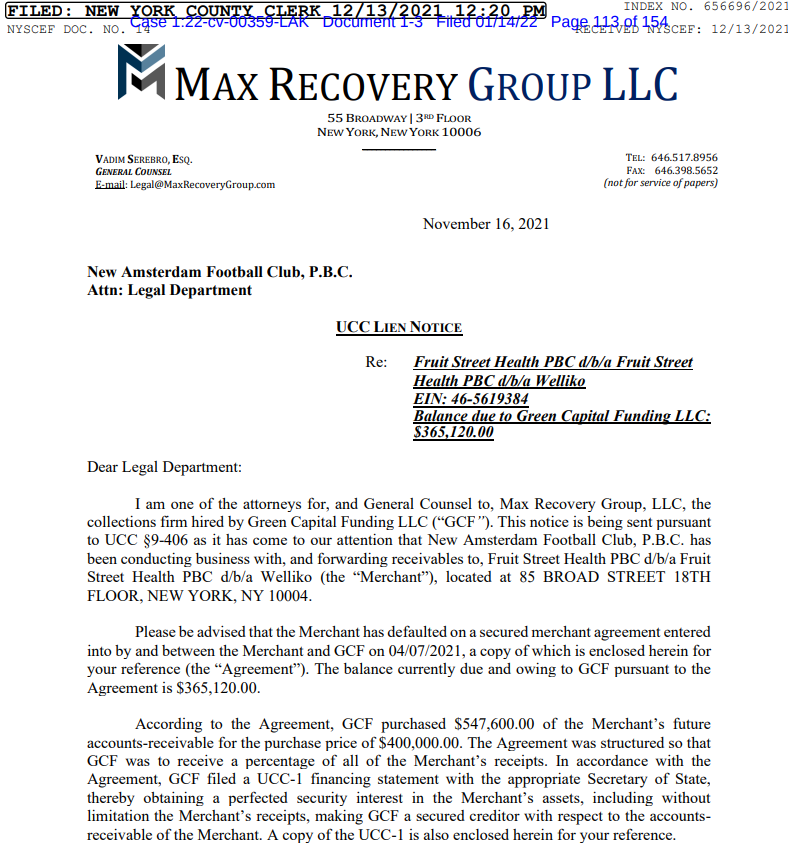

With Fruit Street unable to pay, Max Recovery Group LLC, a collection agency and another named defendant, went after the company for collection. The company sent UCC lien notices stating that any receivables due Fruit Street should be sent directly to them per their MCA agreements. According to the documents, these notices were sent to Fruit Street customers and non-customers alike. These included notices sent to medical doctors who had invested in Fruit Street as well as a notice to New Amsterdam FC. The complaint notes that the team is “a privately owned soccer team that owes no receipts to Fruit Street. Instead, it is a company owned by the guarantor of the Yellowstone MCA agreements, Girard, and was thus sent in a blatant attempt to intimidate and harass.”

On October 27, 2021, Green Capital filed judgment against Fruit Street and Girard seeking over $350,000. According to the complaint, that filing was rejected by the New York County Clerk, but does not give the reason for that rejection. The documents state that Fruit Street had received $960,135 from the MCA companies and had paid back more than $1.3 million.

The complaint puts forward three causes of action. First, Fruit Street and Girard claim that the agreements were not actually a purchase of receivables but written as such to hide that they were loans which would therefore violate New York state usury law. The complaint states that under New York law loans with an interest in excess of 25% are illegal. The second cause of action asks that the defendants are engaging in an organized criminal activity and are in violation of federal RICO laws. Finally, the third cause of action is that the defendants are involved in a conspiracy.

The plaintiffs seek to vacate the judgment allowing Green Capital to seek payment of the outstanding amount of the MCA agreement. In addition they want the court to declare each of the MCA agreements void and unenforceable. Fruit Street and Girard also seek other damages to be determined at trial and they are entitled to treble damages under federal law. Currently, the defendants have through February 18 to respond to the complaint.

Last month, NISA voted to not allow New Amsterdam FC to take part in the 2022 league season. Girard has publicly stated that he will file a suit against the league, and other individuals, to seek an injunction to allow the club to play. It is not known the status of that legal action.

- Dan Creel

Below is a collection of public information regarding the suit.